|

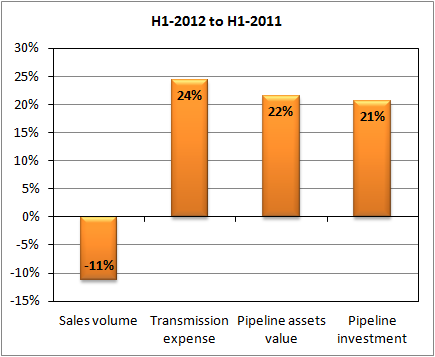

Gazprom's financial results for H1-2012 show significant growth

of nearly all cost components and decrease of gas volumes sold to

all markets. Compared to H1-2011, volumes of natural gas sold in

Russia dropped 6%, former Soviet Union 29% and exports to other

countries (mostly Europe) 10%. Totally, Gazprom sold 11% less gas

than in the same period of 2011. Despite the growth of price in all

market segments, gas sales revenue decreased 3%.

Observing dropping sales, Gazprom is

steadily increasing its capital investment. The value of gas

transportation assets is 22% higher than in the end of June 2011 and

the total gas transmission expense is up 24%. A vast majority of new

pipeline projects of Gazprom do not generate additional profits for

the company's shareholders. On the contrary, these pipelines reduce

the profits.

It worth noting that the state budget

reimburses Gazprom's operational losses at the recently commissioned

Sakhalin-Khabarovsk-Vladivostok pipeline (Rub 11.2 Billion in

2012). The size of gas market at the end of this 467-billion-rouble

pipeline is still uncertain. Nevertheless, Vladimir Putin ordered

Gazprom to build

another 3200-km pipeline to Vladivostok. Total cost of the

proposed

Yakutia-Khabarovsk-Vladivostok pipeline is estimated at Rub 770

Bn. The full-scale construction of new gas pipelines has just

started. In the mid-term, the annual pipeline investment is unlikely

to go down until Gazprom runs out of cash.

|

Source:

Gazprom |

Source:

Gazprom |

Things are no better at the production

side. Gas production cost in Q2-2012 was 81% higher than in the same

period of 2011. Excluding the effect of severance tax raise, the

production cost went up 63%.

By huge overinvestment during the

period of uncertainty, Gazprom executives expose the company to

tremendous risk. After the commissioning of South Stream and its

feeding pipelines, the delivered cost of Russian gas at the EU

border is very likely to exceed $14/MMBtu. The price in Europe may

not be that high and the federal budget of Russia may not be able to

reimburse all losses caused by excessive pipeline construction.

Gazprom is getting closer to the point of no return.

Mikhail Korchemkin

East European Gas

Analysis

Malvern, PA, USA

November 6, 2012

Reproduction or use of

materials is allowed only with reference to East European Gas

Analysis or www.eegas.com

|