|

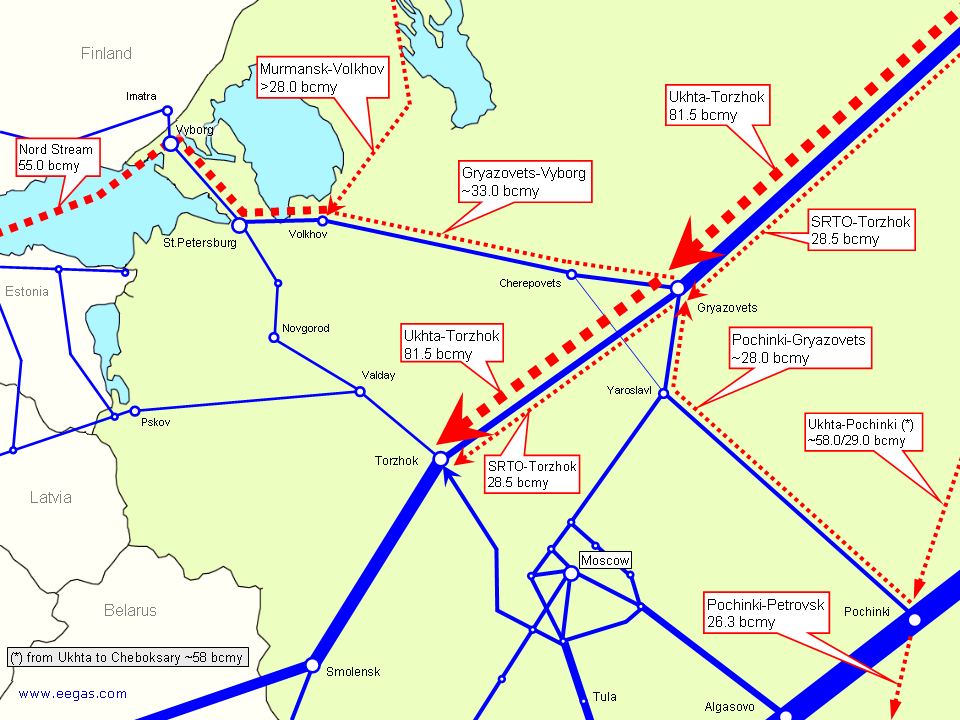

Gazprom plans to increase the

capacity of the Northern Lights pipeline from Ukhta to Torzhok by 110 billion cubic meters a year (bcm/y), which

is more than the combined capacity of the Blue Stream, Nord Stream and South

Stream projects. However there are no plans for the construction of new

pipelines out of Torzhok. The purpose of this capacity bubble at the

inlet of the Yamal-Europe pipeline, 350 km east of the

Russian border with Belarus, is unclear. The Yamal-Europe

pipeline that delivers Russian gas to Germany via Belarus and Poland has the

capacity of 33 bcmy.

The pipeline construction program of

Gazprom looks irrational. Most of the announced projects are designed to deliver

gas to the three compressor stations of Gryazovets, Torzhok and Volkhov. In the

scheme above, the lines' thickness roughly corresponds to the combined capacity

of the pipeline sections. SRTO stands for the Russian abbreviation of "Northern

Regions of Tyumen Province".

|

Gas pipeline project |

Capacity, bcmy |

|

SRTO - Torzhok |

28.5 |

|

Pochinki - Gryazovets |

~28.0 |

|

Bovanenkovo - Ukhta -

Torzhok |

81.5 |

|

Shtokman - Murmansk -

Volkhov |

Min 28.0 |

|

Total to Gryazovets and

Volkhov: |

Min 166.0 |

Source: Gazprom.

In the next 10-12 years, Gazprom

expects to commission the total new capacity of 166 bcmy in Northwestern region,

including 138 bcmy to deliver more gas to Gryazovets and at least 28 bcmy to

Volkhov. The capacity for exporting gas out of the region is set to grow

by 55 bcmy (the Nord Stream project).

The Gryazovets-Torzhok section is to

get three new pipelines with the combined capacity of 110 bcmy. The purpose of

building all this capacity is unclear. Gazprom can increase the flow out of

Torzhok by a maximum of 48 bcmy by taking the following cost-efficient steps.

About 19-20 bcmy can be used for

exporting additional volumes to Europe. This is the least expensive option of

increasing Gazprom's exports that involves the completion of all compressor

stations at the existing Torzhok-Dolina pipeline (56" or 1420 mm) and the

construction of new pipeline Dolina/Bogorodchany-Uzhgorod

in Western Ukraine. From the standpoint of Gazprom, this project has a major

disadvantage: the pipelines run through the territories of Belarus and Ukraine.

Gazprom can utilize another 28 bcmy

of capacity by reversing the flow in the Tula-Torzhok section of pipelines.

These pipelines would deliver gas from Torzhok to Moscow and Central Russia.

However this technically feasible option would significantly increase the load

of the pipelines in Central Russia in the period when the flow is being reversed.

It would be difficult to use the additional gas south of Torzhok. There is no

spare capacity to export more gas through Ukraine in winter, and the Russian

consumers of Moscow and central provinces can hardly buy all this gas at the

"European price".

Thus the Gryazovets-Torzhok

section gets an excessive capacity of over 60 bcmy. Theoretically, Gazprom may decommission

the two oldest pipelines Ukhta-Torzhok-1 and -2 built in 1969 and 1971, then the

excessive capacity would be reduced to 45 bcmy. In fact, the

decommissioning is very unlikely to happen. Gazprom is steadily increasing pipe

reinsulation and replacement works, which has already resulted in a

significant reduction of pipeline failures.

Defectoscopy and rehabilitation of the Ukhta-Torzhok system is being performed

on regular basis and the pipelines operate under the full load.

Gazprom wants to reduce its

dependence on Ukraine and Belarus for the transportation of gas to Western

Europe. So, the Russian gas monopoly does not announce plans for a

Yamal-Europe-2 project across Belarus and/or Torzhok-Dolina-2 pipeline across

Belarus and Ukraine. However, the declared buildup of excessive capacity at

Torzhok drops a hint that Gazprom may have secret plans of laying these

pipelines in the former Soviet states.

Note that the flow reversal and the

additional exports through Belarus and Ukraine are just our assumptions.

Official publications of Gazprom describe pipeline projects with the capacity of

0.8-4.8 bcmy. Nevertheless the documents do not give any information about the

pipeline capacity of 110 bcmy that can transport two-thirds of the total Russian gas exports

to Europe.

Gazprom's plan also assumes the

construction of a new pipeline corridor from Ukhta to Pochinki

to feed the Blue Stream and South Stream pipelines via the route

Pochinki-Frolovo-Izobil'noe.

The described construction program

needs significant additional investment to create reserve capacity while gas

flows in some pipelines are reversed. It also requires a very accurate

synchronization of the commissioning of new pipeline projects. The program does

not allow any flexibility in respect of the Shtokman project. The second

pipeline Murmansk-Volkhov would mean the major portion of the Gryazovets-Vyborg

pipeline is out of business. Gazprom is building the Gryazovets-Vyborg pipeline

now at the record high cost (see below).

The alternative route from

Bovanenkovo (Yamal peninsula) to Yamburg requires much smaller investment (the

route is shown on

the map of

Gazprom and our map). The completion of all

compressor stations at the SRTO-Urals and Yamburg-Tula-2 pipelines (both running

from Yamburg) can create enough spare capacity to take the flow from the first

Bovanenkovo-Yamburg pipeline. Later on, the deliveries to Yamburg from Yamal

peninsula can be synchronized with the depletion of production at Yamburg,

Urengoy and other gas fields of the region.

The capacity problem in the

Nadym-Pur-Taz region of West Siberia can be solved without Gazprom's investment

by the construction of an independent gas pipeline from West Siberia to

Orenburg or Central Russia.

Investment costs of Gazprom are very

sensitive to the choice of the route for Yamal gas and to the synchronization of

the commissioning time of the production and pipeline projects. For example, a

one-year postponement of the startup of Bovanenkovo can save Gazprom $10-20

billion of investment costs. An relatively small additional investment into the

expansion of underground gas storages can facilitate the fulfillment of

contractual obligations of Gazprom in this period. High investment costs mean

high profits of contractors and low profits of the shareholders of Gazprom.

We plan to run a detailed analysis

of Gazprom's construction plan in the coming 2-3 months.

Mikhail Korchemkin,

director

April 2, 2008

(with additions of April 4, 2008)

APPENDIX:

Construction Cost per 1 km of

Pipeline, Excluding Compressor Stations

|

Pipeline project |

Diameter, mm |

Wall thickness, mm |

RUR Million per 1

km |

|

Gryazovets-Vyborg |

1420 |

21.6 |

138 (a) |

|

Nord

Stream, average per 1 line |

1220 |

26.8-46.0 |

114 (b) |

(a) Cost in

Russian rubles as of November 2005 (!)

(b) At

the RUR/EUR exchange rate of April 2, 2008.

Sources:

Gazprom;

Nord Stream;

OMK (Russian pipeline manufacturer).

Note that 1 meter of steel pipe used

at the Nord Stream project is 42% heavier than that of the Gryazovets-Vyborg

line. Considering the growth of price of steel pipe in the past years, the real

procurement expense (in Russian rubles) per 1 m of pipe bought for the

Gryazovets-Vyborg pipeline in November 2005 should be about half of the price

paid by Nord Stream AG in November 2007. On top of that the concrete expense at

the offshore pipeline is several times higher than at the

land pipeline Gryazovets-Vyborg. It looks like the construction cost of

the onshore pipeline is seriously overestimated.

|